What is Significance of Margin in Trading?

In the field of finance and investment, margin in trading is quite significant and central for share trading online. In the past few decades, with the unconventional mechanisms of trading on the online platform, people invested in financial markets directly, therefore the concept of margin has shone its helpful light. This article focuses on the aspects of margin dealing taking into account the advantages and disadvantages and how it influences various investments.

Defining Margin in Trading

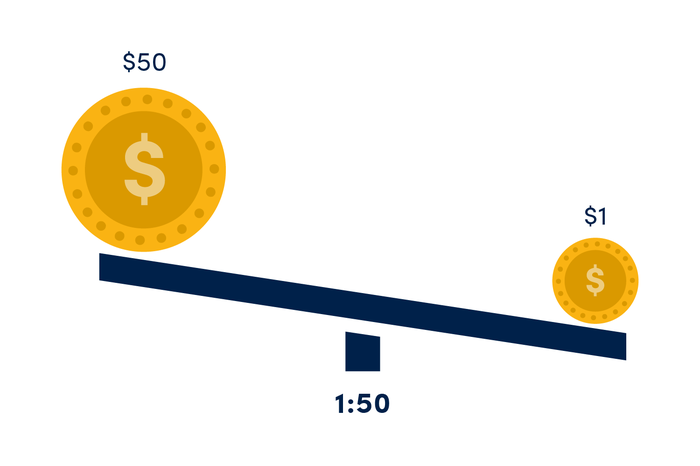

Margin in trading entails using the broker’s money to buy securities, say, stocks or other acceptable securities. This borrowed money becomes Collateral, by which investors can then have greater control over a position than the actual value of the investment they have. In other words, margin trading provides an ability to increase the multiplicative factor of gains – and of losses.

The Mechanics of Margin Trading

When dealing with margin trading, it is essential to have specific capital in the account that an investor cannot use in trading and loses if the price crashes; this amount is called the maintenance margin. This forms the basis for the borrowed cash. Consequently, the particular regulation in regards to margin accounts is contingent upon the broker and securities in question.

For instance, in share trading online, a trader invests $5,000 in their margin account and gets a loan of $5,000 from the broker to acquire $10,000 in stocks. This 50% margin requirement is standard in many jurisdictions although it can differ.

The Significance of Margin in Modern Trading

Increased Purchasing Power

Importance of margin in trading is that it increases the business buying power. Since investors make use of other people’s money, it is possible for the investors to earn high returns on the money they borrowed. It can be especially thrilling during the bull runs or when the investor is confident with the certain investment prospects.

Portfolio Diversification

Margin can also help in expansion of the portfolio by investing in many different types of securities. Thanks to having more funds, investors are able to diversify the investments and therefore minimize risks.

Short Selling Opportunities

Basically, stock on margin permits short selling, a technique that an investor makes profits from a losing share. It means that there is possibility for trader to gain profit from the increasing as well as decreasing market prices.

Flexibility in Cash Management

Margin accounts are thus more advantageous to investors who use their stockbrokers’ trading platforms to actively trade in shares in the market and who require a more flexible arrangement of cash flows. It can implement trades that are free of restrictions of time to settle from previous transactions, possibly benefiting from a timely event.

Risks and Challenges of Margin Trading

Amplified Losses

As margin increases the potential of gains, it similarly increases the potential of losses. When an investment is generating poor returns, the investor not only loses his/her money, but has to repay on top of the borrowed money.

Margin Calls

Margin call occurs when the value of securities in a margin account drops to the level that is lower than maintenance margin requirement. This makes the investor to deposit more funds or securities into the account.

Interest Costs

Margin loans attract a specific interest cost that adds to the cost of investing hence reducing the amount of returns that is earned. These costs become part and parcel of the trader’s investment plan and have to be incorporated when calculating gross profits.

Psychological Pressure

Leverage results in increase in the emotional intensity and possibility of making wrong decisions due to change in the market conditions.

Margin in the Context of Online Share Trading

Increased Accessibility

Margin trading has become more accessible to people due to share trading online reducing the hurdles to leverage. This has led to new avenues of generating wealth but has also put the Venezuelan investors especially the inexperienced ones into new levels of risk.

Real-time Monitoring

This means that through the internet, account information is available in real-time and this enables persons who invest through margin to constantly keep track of their positions. In doing so, the transparency can assist traders in making better decisions and respond to the changes wrong in the market.

Automated Margin Calls

Some of the features of the online brokers are administrative systems for making margin calls and closing its positions when useful. Although this would serve to safeguard the interest of the broker as well as the investor at some point it also triggers; forced sales which may be at the wrong time.

Educational Resources

The most established online trading platforms tend to offer learning resources on margin trading as investors learn about risks and responsibilities.

Regulatory Considerations

Due to the dangers involved in the margin trading, various over seeing authorities have put measures in place in order to safeguard investors. For example, in the United States, Regulation T of the Federal Reserve prescribes initial margin requirements while FINRA’s rules regulate maintenance margins. These are some of the regulations that apply to those investors who trade in shares over the internet, and hence should know about them.

Strategies for Responsible Margin Use

Conservative Leverage

It is possible to cut risks and still have some advantages of leverage if margin is used sparingly, rather than as a way to borrow as much as possible.

Risk Management

It is also important to use the tools of trading such as stop-loss orders and avoid concentration of investments when using the margin trading strategy.

Continuous Education

It is necessary to track market and legislative changes, as well as popular techniques for trading with margins.

Regular Account Monitoring

It is advisable for traders to regularly look at the margin and the status of their accounts so that can avoid receiving unpleasant shocks in form of margin calls and forced selling.

Conclusion

Margin in trading is one of the most valuable instruments that can really strengthen an investor’s ability interacting with the financial markets. It provides the buyer with better purchasing prospects, product differentiation, and choosing of various trading techniques. Nevertheless, some points concerning leverage cannot be described as safe at all. Given the fact that losses may be rather amplified in this case, it is possible to face margin calls, and the psychological pressure would also be higher; thus, margin trading is a rather challenging task that should be addressed with certain caution.

Trading in shares has become more of an online affair and margin more easily available than in the past and this is why emphasis on relevant education and proper usage is so important. Margin trading like any other investment plan requires that one should know the working, the risks that are associated with it and the laws that govern the whole process.